Managing money can feel overwhelming, especially when your salary has to cover bills, savings, and lifestyle expenses. The truth is, most people don’t fail at money because they earn too little — they fail because they don’t have a clear plan.

That’s where the 50/30/20 rule of budgeting comes in. It’s one of the simplest and most effective methods for managing your salary. Whether you earn $2,000 or $20,000 a month, this framework helps you understand exactly where your money should go.

Imagine this: You get your paycheck on Friday, pay a few bills, grab dinner out, and by the following Thursday you’re already wondering where your money went. This cycle is common, and it’s why so many people feel stuck financially. The 50/30/20 rule gives you a roadmap to break that cycle. Instead of guessing, you’ll know exactly how much to spend, save, and enjoy—every single month.

In this guide, we’ll explain what the 50/30/20 rule is, why it works, how to apply it to your salary, and practical tips to make it stick. By the end, you’ll know how to balance enjoying life today while saving for tomorrow.

What Is the 50/30/20 Rule?

The 50/30/20 rule is a personal finance strategy that divides your after-tax income into three categories:

- 50% Needs: Essential expenses such as rent, utilities, groceries, transportation, and insurance.

- 30% Wants: Lifestyle choices like dining out, shopping, entertainment, or hobbies.

- 20% Savings & Debt Repayment: Emergency fund, investments, retirement savings, and paying off loans.

This balance ensures you cover necessities, enjoy life, and still build long-term financial security.

👉 Think of it as a “money diet” — just like nutrition requires balance between proteins, carbs, and fats, your budget requires balance between needs, wants, and savings.

Why the 50/30/20 Rule Works

The reason this method has stood the test of time is because it’s both practical and psychological. Here’s why:

- Simplicity: With only three categories, you don’t need to track every cup of coffee. Instead of feeling guilty about every little expense, you just make sure your “wants” stay within 30%. Example: If you want to buy new sneakers this month, that’s fine—as long as your wants category allows it.

- Flexibility: The percentages scale with your income. Whether you earn $2,500 or $10,000 per month, the framework adapts. Someone on $2,500 can still apply the rule with smaller numbers, while a high earner can use it to prevent lifestyle inflation.

- Balance: Unlike restrictive budgets that cut out all fun, the 50/30/20 rule recognizes that enjoyment matters. If you love traveling or dining out, you can do it guilt-free as long as it’s within the 30%. That balance keeps you motivated long term.

👉 For a deeper dive, check Investopedia’s 50/30/20 Rule guide.

How to Apply the 50/30/20 Rule to Your Salary

Let’s say your monthly salary is $4,000 (after tax). Here’s how it breaks down:

- 50% Needs = $2,000

- Rent: $1,200

- Groceries: $400

- Utilities & bills: $200

- Transportation: $200

- 30% Wants = $1,200

- Dining out: $500

- Shopping: $400

- Entertainment: $300

- 20% Savings & Debt Repayment = $800

- Emergency fund: $200

- Investments: $400

- Loan repayment: $200

👉 Pro Tip: Automate your savings transfer on payday so you never “forget” to save.

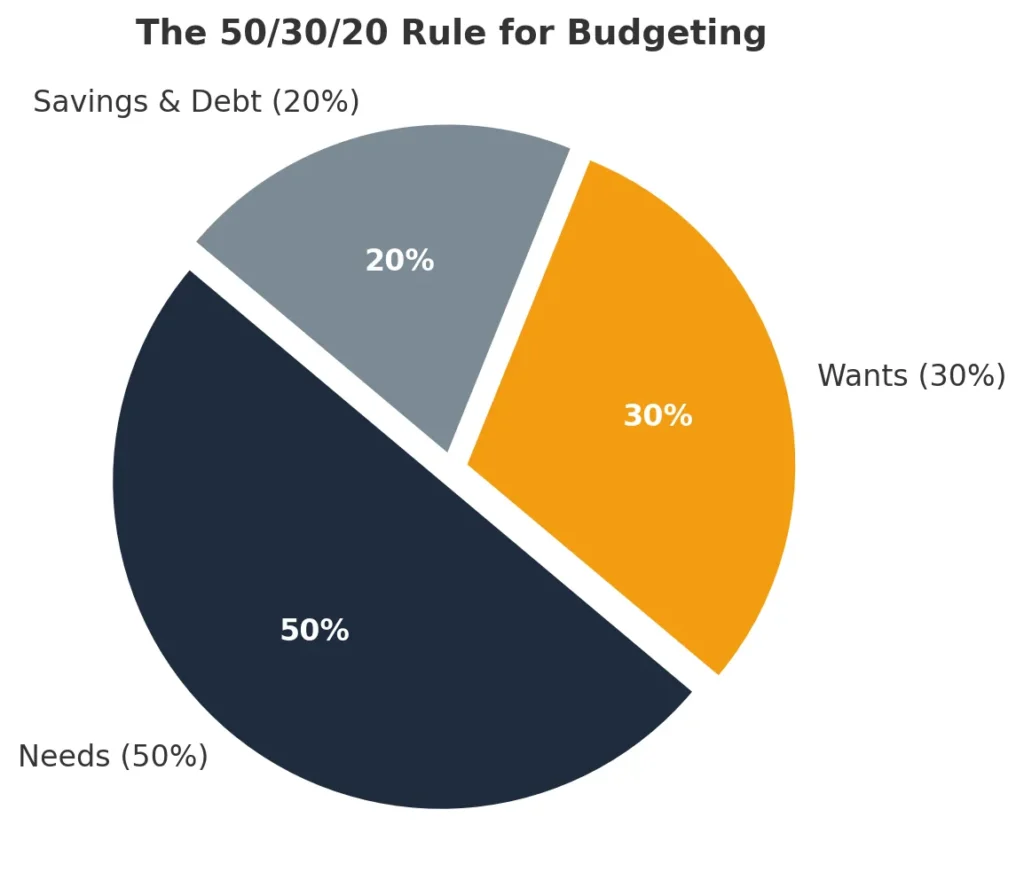

Visual Breakdown

Here’s how the 50/30/20 split looks in a pie chart:

📊 Pie Chart: The 50/30/20 Rule

- Needs = 50% ($2,000)

- Wants = 30% ($1,200)

- Savings/Debt = 20% ($800)

Real-Life Example: $2,500 Salary vs $6,000 Salary

Here’s how the 50/30/20 rule works with different salaries:

- $2,500 Salary → $1,250 needs, $750 wants, $500 savings.

- $4,000 Salary → $2,000 needs, $1,200 wants, $800 savings.

- $6,000 Salary → $3,000 needs, $1,800 wants, $1,200 savings.

- $10,000 Salary → $5,000 needs, $3,000 wants, $2,000 savings.

- At higher incomes, the challenge isn’t survival—it’s lifestyle inflation. Many high earners accidentally let their “wants” balloon, buying luxury items or overspending on vacations. Using the 50/30/20 rule helps them stay disciplined: the more they earn, the more they automatically save, which accelerates wealth building.

👉 Notice how the proportions stay the same, but the actual amounts change. This is why the rule works for almost any income bracket.

Pro Tip: If your rent or housing costs are higher than 50% of income, adjust slightly — cut wants to 20% and put the extra into needs until your situation improves.

Common Mistakes to Avoid

- Confusing Wants with Needs

- This is the most common error. For example, groceries are a need, but dining at a fancy restaurant is a want. A car may be a need for commuting, but upgrading to a luxury vehicle is a want. Mixing the two leads to overspending.

- Overspending on Lifestyle

- Many people allow “wants” to creep up slowly. Streaming services, new gadgets, frequent online shopping—all small amounts that add up. Before you know it, wants exceed 40–50% of your income, leaving little for savings.

- Skipping Savings

- People often think, “I’ll save whatever is left at the end of the month.” The problem? There’s rarely anything left. By prioritizing savings first (20%), you flip the script and guarantee progress toward long-term goals.

- Not Accounting for Debt

- If you have credit card balances or student loans, you may need to adjust the ratio to 40/30/30 (more toward debt and savings). Sticking rigidly to 50/30/20 won’t work if your debt burden is high.

Alternatives to the 50/30/20 Rule

The 50/30/20 rule isn’t the only way to budget. Here are two popular alternatives:

- 70/20/10 Rule: 70% needs, 20% savings, 10% wants. Ideal if you’re repaying heavy debt.

- Zero-Based Budgeting: Every dollar has a job (savings, spending, investing). Great for detail-oriented people.

FAQs About the 50/30/20 Rule

1. Is the 50/30/20 rule realistic for low-income earners?

Yes, but flexibility is key. If essentials like rent and groceries take up more than 50%, reduce your wants category. Even if you can only save 10–15%, that’s better than nothing. The rule is a guide, not a rigid law.

2. Can I use this rule if I live in an expensive city?

Absolutely. In cities where rent is very high, many people find their needs take 60%. In that case, you might do 60/20/20 or 60/25/15. The important thing is that you’re still tracking and controlling spending.

3. Should savings include retirement contributions?

Yes. Retirement contributions, emergency fund deposits, investments, and debt repayments all belong in the 20% category. If your employer automatically deducts retirement contributions, you can count that as part of your savings.

4. How do I actually track spending under this rule?

You don’t need complex spreadsheets. Budgeting apps like YNAB, Mint, or PocketGuard categorize expenses automatically. If you prefer simple tools, even a Google Sheet with three columns (Needs, Wants, Savings) works. The key is consistency, not perfection.

5. Can I modify the rule?

Definitely. The 50/30/20 rule is a starting point. If you’re aggressively saving for a house, you could do 50/20/30 (with 30% for savings). If you’re paying off big debts, a 40/30/30 split may make more sense.

Final Thoughts

The 50/30/20 rule is more than just numbers—it’s a mindset shift. By giving every dollar a job, you avoid the stress of wondering where your money went each month. The beauty of this method is that it’s simple enough for beginners yet flexible enough to adapt to any stage of life.

If the exact percentages don’t fit your situation, adjust them slightly. What matters most is that you consistently save and keep lifestyle spending under control. Over time, even small percentages add up.

The best part about the 50/30/20 rule is that you don’t have to wait for a perfect moment to begin. You can start with your very next paycheck, even if your savings contribution is small. Over time, the habit of consistent saving and balanced spending matters more than the exact amounts.

So don’t overthink it—set up your categories, automate your savings if possible, and try the rule for three months. You’ll quickly see how much clarity and control it brings to your financial life.

2 Comments on “The 50/30/20 Rule Explained: How to Manage Your Salary Smartly”