In today’s world, more people are realizing that simply saving money in a bank account is not enough to build long-term wealth. Inflation eats away at savings, while opportunities for growth exist in the stock and bond markets. But managing individual investments can feel overwhelming—especially for beginners in 2025, when new options like robo-advisors and apps compete for attention.

That’s why mutual funds continue to stand out. They combine professional management, diversification, and affordability, making them one of the most beginner-friendly ways to invest. This beginner’s guide to investing in mutual funds 2025 will break everything down step by step so you can start with confidence.

Beginner’s Guide to Investing in Mutual Funds: What Are They?

A mutual fund is a pool of money collected from many investors, managed by professionals. The fund invests in a mix of assets such as stocks, bonds, and other securities.

Instead of buying a single stock yourself, you buy “shares” of the mutual fund, and the fund manager decides how to distribute the money across different investments.

👉 In simple words: it’s like joining a group project where experts do the hard work of picking investments for you.

Benefits of Investing in Mutual Funds

- One of the main reasons mutual funds are considered among the best beginner investments in 2025 is their simplicity. Let’s break down the key advantages:

- Diversification → Your money is spread across many assets, reducing risk.

- Professional Management → Fund managers analyze the market for you.

- Affordable Entry → Many funds let you start with as little as $100.

- Liquidity → Easy to buy or sell shares when needed.

- Compounding Growth → Reinvested earnings help your wealth grow faster.

Let’s look at a practical example. Imagine investing only in one company’s stock. If that company struggles, your investment takes a big hit. But with mutual funds, diversification spreads your money across dozens—or even hundreds—of companies, reducing risk.

Professional management is another major advantage. Instead of trying to read financial reports or time the market yourself, fund managers handle this for you. Many funds also give you the option to automatically reinvest dividends, which helps accelerate compounding growth.

Finally, entry is affordable. Decades ago, investing in funds often required thousands of dollars. Today, many brokers let you start with as little as $100 or even less if you use automated platforms.

Pros and Cons of Mutual Funds

- Pros: Easy to start, diversified, professionally managed.

- Cons: Fees can be higher than ETFs, no guaranteed returns, not ideal for short-term trading.

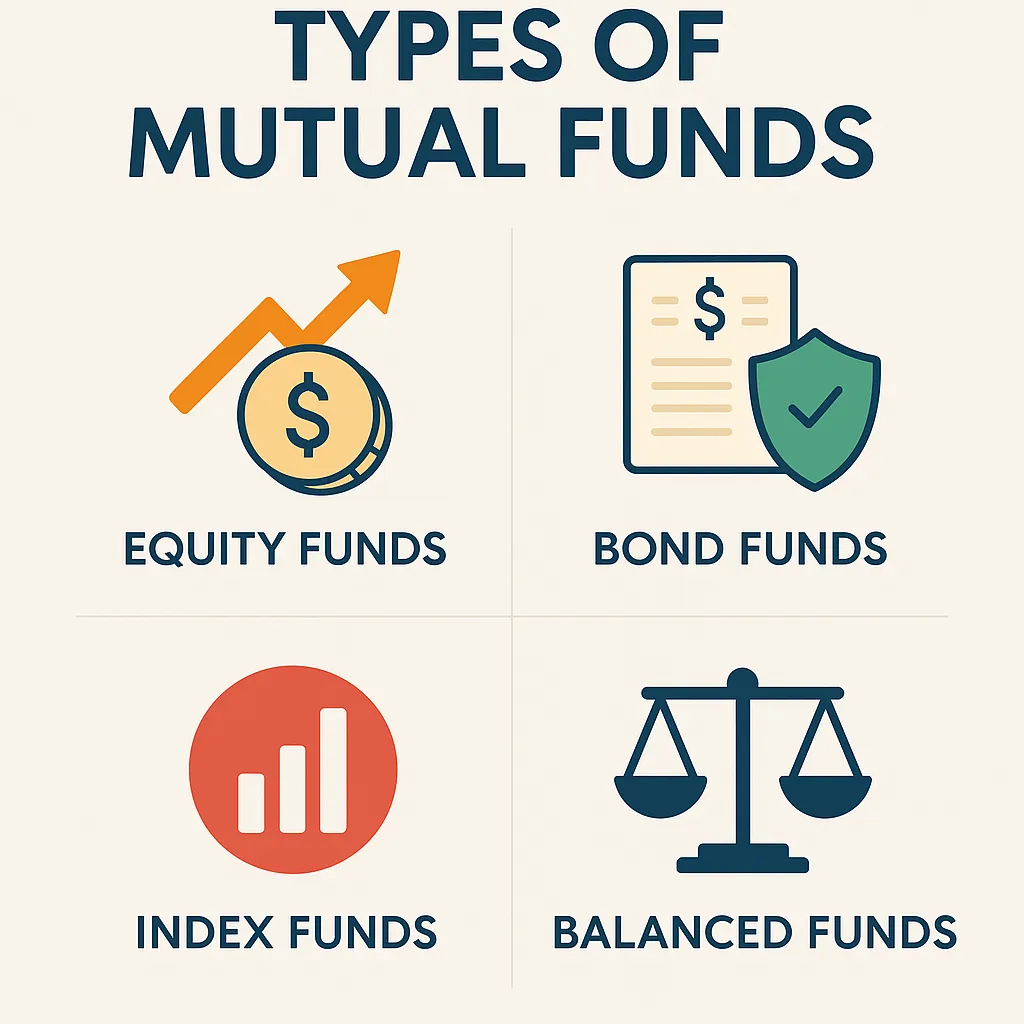

Types of Mutual Funds

- Not all mutual funds are the same. Here are the main categories every beginner should know:

- Equity Funds → Invest mainly in stocks. Higher risk, but potential for higher returns.

- Example: A U.S. stock market mutual fund.

- Bond Funds → Invest in government or corporate bonds. Lower risk, stable income.

- Example: A government bond fund.

- Index Funds → Track a market index (like the S&P 500) with lower fees.

- Example: Vanguard 500 Index Fund.

- Balanced Funds → Mix of stocks and bonds for stability.

- Example: A 60% stock, 40% bond portfolio.

For beginners, here are some well-known real-world examples:

- Equity Funds: Vanguard Total Stock Market Fund (VTSAX) → covers the entire U.S. stock market.

- Bond Funds: Fidelity U.S. Bond Index Fund (FXNAX) → focuses on stable government and corporate bonds.

- Index Funds: Vanguard 500 Index Fund (VFIAX) → one of the oldest and most trusted.

- Balanced Funds: T. Rowe Price Balanced Fund (RPBAX) → a mix of stocks and bonds for steady growth.

By understanding these categories and examples, you can choose a fund that matches your goals and risk tolerance.

- 👉 See the infographic below for a visual breakdown of the types of mutual funds for beginners.

Beginner’s Guide to Investing in Mutual Funds: How to Start Step by Step

If you’re a beginner wondering how to start investing in mutual funds, these steps will guide you:

- If you’re a beginner wondering how to start investing in mutual funds, these steps will guide you:

- Set a Goal → Are you saving for retirement, a house, or general wealth?

- Choose a Fund Type → Equity for growth, bond for safety, or balanced for both.

- Pick a Trusted Platform → Online brokers, robo-advisors, or your bank.

- Start Small → Even $100–$200 per month adds up over time.

- Stay Consistent → Investing works best long term (think 5–10 years).

Example: Investing $200 Monthly

If you invest $200 per month into a mutual fund with an average annual return of 8%:

- After 5 years, you’d have around $14,700.

- After 10 years, you’d have over $36,000.

- After 20 years, you’d have more than $118,000.

- After 30 years, your account could grow to over $300,000.

This is the power of compounding: the earlier and more consistently you start, the greater the rewards.

Risks of Mutual Funds

- Like all investments, mutual funds carry some risks:

- Market Risk → The value of your investment can go down during market downturns.

- Management Fees → Some funds charge high expense ratios.

- No Guaranteed Returns → Performance depends on the market and the manager.

- Inflation Risk → If inflation rises faster than your fund’s returns, your real purchasing power decreases.

- Manager Risk → Some funds underperform because the manager makes poor decisions. This is why many investors prefer index funds, which track the market instead of relying on active management.

👉 Pro Tip: Always check the fund’s expense ratio (aim for under 1%). Lower fees mean more of your money stays invested.

Who Should Invest in Mutual Funds?

Mutual funds are a great choice for:

- Beginners who want a simple way to start investing.

- Busy professionals who don’t have time to research individual stocks.

- Long-term investors focused on retirement or wealth building.

Mutual funds may not be ideal for:

- Traders seeking short-term gains.

- Investors who dislike paying management fees.

- People who prefer total control over their investments.

Mutual Funds vs ETFs vs Stocks

If you’re still unsure whether mutual funds are right for you, here’s how they compare:

- Mutual Funds → Managed by professionals, great for beginners, but fees can be higher.

- ETFs (Exchange Traded Funds) → Similar to mutual funds but trade like stocks; usually cheaper.

- Individual Stocks → High risk, high reward. Great for advanced investors but risky for beginners.

FAQs About Mutual Funds

1. Can I lose money in mutual funds?

Yes. Mutual funds are tied to the performance of the market. During downturns, your investment value may drop. However, diversification means you’re less exposed than if you held only one or two stocks. Over the long term, markets historically trend upward, which is why many investors stay invested for 10+ years.

2. How much money do I need to start?

Some funds require a $1,000 minimum, but many online brokers and robo-advisors allow you to begin with $100 or even less. The important thing is not the starting amount but the habit of consistent investing. Even small monthly contributions can grow significantly over time.

3. Are mutual funds better than savings accounts?

For short-term needs (like emergency funds), savings accounts are safer because they don’t lose value. But for long-term goals like retirement, mutual funds usually deliver much higher returns. For example, a savings account might earn 2–3% interest, while mutual funds historically return 6–10% annually.

4. How do I know which mutual fund to pick?

Start by considering your goals and timeline. If you want long-term growth, an equity or index fund may be best. If you want stability, a bond or balanced fund might suit you. Always check the fund’s expense ratio (fees) and past performance compared to its benchmark index.

Final Thoughts

Mutual funds remain one of the smartest entry points for new investors. They’re simple, affordable, and effective at balancing risk with reward. The key is to align your choice of fund with your financial goals—whether that’s retirement, buying a home, or building general wealth.

As this beginner’s guide to investing in mutual funds 2025 has shown, starting small and staying consistent is the best way to build wealth. Even if you begin with just $100, time and compounding can turn small contributions into significant long-term gains.

The earlier you start, the greater the impact. So don’t wait—take the first step today and let your money work for you.

👉 Related: The 50/30/20 Rule Explained: How to Manage Your Salary Smartly

👉 Further Reading: Morningstar Beginner’s Guide to Mutual Funds

One comment on “Beginner’s Guide to Investing in Mutual Funds: How to Start Step by Step”