Emergency Fund Mistakes

Imagine this: your car suddenly breaks down, your child wakes up with a high fever, or you receive an unexpected job termination letter. In moments like these, your financial stability can vanish overnight. If you don’t have an emergency fund, your only options may be to swipe a credit card, borrow from friends, or take out a loan — all of which create long-term stress and That’s how you know you got into one of Emergency Fund Mistakes.

An emergency fund is a dedicated pool of money set aside for unexpected expenses. It’s not for vacations, gadgets, or shopping sales; it’s your safety net when life throws the unexpected your way. Yet, even when people try to build one, they often fall into common traps that weaken the fund’s effectiveness.

According to surveys, nearly 60% of adults worldwide don’t have enough savings FRR to cover even one month of expenses. In the U.S., for example, the Federal Reserve reports that almost 40% of Americans would struggle to cover a $400 emergency without borrowing. These numbers highlight just how critical an emergency fund is — and how common it is for people to underestimate their vulnerability.

Let’s dive into the Emergency Fund Mistakes people make with their emergency funds — and how you can avoid them to secure your finances.

Mistake #1: Not Starting Early Enough

One of The biggest Emergency Fund Mistakes is waiting until life hits you with a crisis. Emergencies don’t wait for “the right time.” Many people postpone saving, thinking they’ll start when they earn more. Unfortunately, that day rarely comes.

- Why it’s harmful: Without a cushion, you’re forced into debt the moment something goes wrong.

- Example: Someone who saves just $20 a week ends up with over $1,000 after a year. It’s small, but it’s a start — and it beats zero.

- Fix: Automate small transfers right after payday. Starting early, even with tiny amounts, builds momentum and financial discipline.

Mistake #2: Saving Too Little

Medical bills, or months without income.

Fix: Calculate your monthly must-haves (rent, utilities, groceries, insurance) and multiply by 3–6 to determine your ideal fund size.

Guideline: Aim for 3–6 months of essential expenses.

Singles: 3 months may be enough if you live alone with low expenses.

Families: With dependents, aim for 6–12 months of expenses for extra security.

Think of it this way: if your rent is $1,200, groceries $400, and other bills $600, that’s $2,200 a month. A three-month fund means $6,600, while six months means $13,200. Seeing the actual math often helps people realize that $500 won’t go very far — it might cover a car repair, but not unemployment. Writing down your “monthly survival number” can help you set a realistic target.

RELEATED : Emergency Fund: Uses and How to Build Yours

Mistake #3: Keeping Money in the Wrong Place

Where you keep your emergency fund matters just as much as how much you save.

here are options on what to avoid and what’s the best regarding Emergency Fund Mistakes :

- Bad options:

- Under the mattress (unsafe, no growth).

- In a checking account (too tempting to spend).

- In stocks or crypto (too volatile — imagine needing money in a crash).

- Best options:

- High-yield savings account (HYSA): safe, accessible, earns interest.

- Money market account: liquid, conservative, sometimes with higher rates.

Your priority isn’t profit — it’s safety + liquidity.

A good test: ask yourself, “Can I access this money in 24 hours without penalty?” If the answer is no, it’s not the right place for your emergency fund. Many people learned this the hard way during the COVID-19 pandemic when investments lost value right as they needed cash. The safest emergency fund is boring — and that’s the point.

Remember: liquidity and safety > high returns. = no Emergency Fund Mistakes

Emergency Fund Mistake #4: Mixing It With Everyday Spending

When your emergency fund sits in the same account as your grocery money, you’ll end up dipping into it for “minor” expenses.

- Why it’s risky: You’ll deplete your safety net without realizing it.

- Fix: Create a separate savings account just for emergencies. Better yet, keep it at a different bank so you’re not tempted to transfer it impulsively.

Emergency Fund Mistake #5: Not Defining What Counts as an “Emergency”

Without rules, people misuse their fund. Is a wedding an emergency? A holiday sale? The latest phone? Absolutely not.

✔️ Real emergencies: job loss, urgent medical expenses, car breakdown, essential home repair.

❌ Non-emergencies: vacations, shopping, gifts, planned expenses.

Tip: Write down your definition of emergencies and share it with your family. That way, everyone is on the same page.

Medical bills for unexpected illnesses (check out our article on Vaccines: A Parent’s Guide for how prevention matters).”

Emergency Fund Mistake #6: Forgetting to Refill It After Use

Using the fund is fine — that’s what it’s there for. The mistake is failing to replenish it afterward.

- Why it matters: Emergencies often come in waves. If you don’t refill the fund, the next crisis could hit harder.

- Fix: Set an automatic transfer to refill the account after you dip into it, just like you’d repay a loan.

Mistake #7: Ignoring Inflation and Lifestyle Changes

The $5,000 fund you built in 2015 won’t cover 2025 expenses. Inflation, kids, rent hikes, and new responsibilities all increase your costs.

- Fix: Review your emergency fund once a year. Adjust the target upward to match your current cost of living.

Mistake #8: Treating It Like an Investment

Some people try to “grow” their emergency fund by investing it in stocks or long-term bonds. That’s dangerous.

- Why it’s wrong: You could lose 30% or more right when you need the money.

- Rule: Emergency money must always be liquid and safe, not speculative. Keep investing separate from your safety net.

The Psychology of Emergency Funds

Why do people fail at saving for emergencies? Often, it’s psychological:

- Optimism bias: “It won’t happen to me.”

- Lifestyle inflation: Spending rises with income, savings don’t.

- Discipline issues: People hate “locking money away” where it’s not exciting.

Fix: Automate savings. Treat it as a bill you pay to your future self.

Behavioural economists call this the present bias — we value immediate rewards (a night out, new gadget) more than future security. One way to overcome it is by “paying yourself first.” Treat your emergency fund contribution like a non-negotiable bill. Another trick is visualization: imagine how calm you’d feel knowing you could handle six months without income. That sense of control is often more motivating than numbers on a spreadsheet.

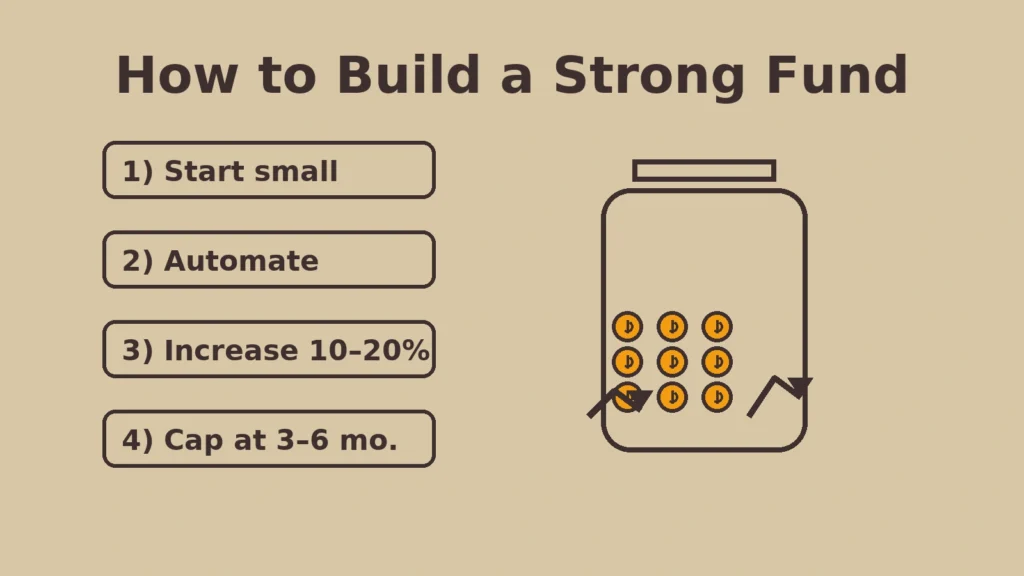

Pro Tips & Strategies for Success

- Start with a $1,000 mini-goal. It’s manageable and gives instant peace of mind.

- Automate transfers. Out of sight, out of mind.

- Boost with windfalls. Tax refunds, bonuses, or side hustle income = emergency fund fuel.

- Name your account. Label it “Emergency Fund Only” to remind yourself not to touch it.

- Layer it. Have a quick-access portion (bank account) and a secondary cushion (money market).

Emergency Fund Action Framework:

- Week 1: Open a separate savings account and nickname it “Emergency Fund.”

- Month 1–3: Build a $1,000 starter fund. Automate transfers on payday.

- Month 4–12: Increase contributions to reach 3 months of expenses.

- Year 2–3: Expand to 6 months (or more if you have dependents).

- Every Year: Review, adjust for inflation, and reset goals.

Following a structured timeline like this keeps the process less overwhelming and ensures steady progress.

Emergency Fund vs. Other Savings

People often confuse emergency funds with other financial goals:

- Retirement savings: long-term, not liquid. Never touch for emergencies.

- Sinking funds: money for planned expenses (vacations, holidays, new appliances).

- Investments: wealth growth, but too risky for emergencies.

👉 Rule of thumb: If it’s unexpected and urgent, it belongs in the emergency fund.

Another important distinction: insurance vs. emergency funds. Insurance covers specific risks (health, auto, home), but policies often don’t pay immediately and rarely cover everything. Your emergency fund bridges that gap, covering deductibles, delays, or expenses not included in insurance. In other words, insurance and emergency savings work together — not as substitutes.

FAQs About Emergency Funds

FAQs About Emergency Funds

1. How much should I save in my emergency fund?

3–6 months of essential expenses. Families or freelancers may need 6–12 months.

2. Where should I keep my emergency fund?

In a high-yield savings or money market account. Avoid risky investments.

3. Do I still need one if I have credit cards?

Yes. Credit is debt with interest; an emergency fund is cash without strings attached.

4. Should I keep any of it in cash at home?

A small amount ($200–$500) for power outages or banking issues is fine. The bulk should stay in the bank for safety.

5. What if I’m a student or on a low income?

Save what you can — even $10 a week matters. Focus on building a starter fund ($500–$1,000) first.

6. Can I invest part of my emergency fund for growth?

No. The purpose is liquidity and stability, not returns. Keep investments separate.

7. How often should I review it?

Once a year or whenever your lifestyle changes (new baby, higher rent, medical needs).

8. Do couples need separate emergency funds?

Not necessarily. A joint fund can cover shared expenses, but couples should agree on the rules for use.

9. How should retirees handle emergency funds?

Retirees still need them. Medical bills, home repairs, or sudden family needs can’t always wait for investments to be sold. Keep at least 1–2 years of expenses liquid.

10. What if a global crisis hits (like COVID-19)?

This is when longer funds (6–12 months) prove critical. Widespread layoffs and disruptions make larger buffers invaluable.

11. Should I invest once my fund is full?

Yes. After securing your emergency fund, direct extra money into retirement accounts or investments where it can grow.

Conclusion

An emergency fund is not about wealth — it’s about peace of mind. By avoiding these mistakes, you’ll create a fund that works when you need it most. Don’t wait until disaster strikes. Start today, even if it’s just $20. Build it step by step, and your future self will thank you.

Remember: financial security isn’t built overnight. It’s a gradual process of consistent saving, smart planning, and avoiding these common mistakes. Every dollar you set aside is a step away from stress and a step toward freedom. The peace of mind an emergency fund brings is priceless — because when life happens, money should be the last thing you worry about.

“Just like establishing routines for better health (see our post on Baby Sleep Training), building financial routines gives long-term peace of mind.”